New Jersey offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

New Jersey Clean Energy Program

New Jersey Center for Sustainable Energy

New Jersey Natural Gas – SAVEGREEN Residential Rebate Program

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

New Jersey Government

The Office of Legislative Services

Office of Public Information

Room B50, State House Annex

Trenton, NJ 08625-0068

Phone: (609) 847-3905

Toll Free: (800) 792-8630

[email protected]

Hours: M-F 9:00am – 5:00pm,

subject to change

Public Service Enterprise Group Incorporated(PSEG)

80 Park Plaza

Newark, NJ 07102

(800) 436-7734

Hours: 7:00am – 8:00pm

New Jersey Board of Public Utilities – Division of Energy

44 S. Clinton Avenue

Trenton, NJ 08625

(800)-624-0241

[email protected]

Hours: M-F 9:00am – 5:00pm,

subject to change

National Weather Service

1325 East West Highway

Silver Spring, MD 20910

Main: (828) 271-4800

Fax: (828) 271-4876

TTY: (828) 271-4010

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | 100% of added property value | Individuals who install a renewable energy system |

| Successor Solar Incentive(SuSI) Program | $85 per 1,000 kilowatt-hours (kWh) of energy generated | Property and business owners with solar panel systems selling SREC-IIs |

| Solar Energy Sales Tax Exemption | 100% of state sales tax on a solar system | Individuals who purchase a home solar system |

| New Jersey Zero Emission Incentive Program | $20,000-$175,000 | Businesses and institutions purchasing new, medium-duty zero-emission vehicles |

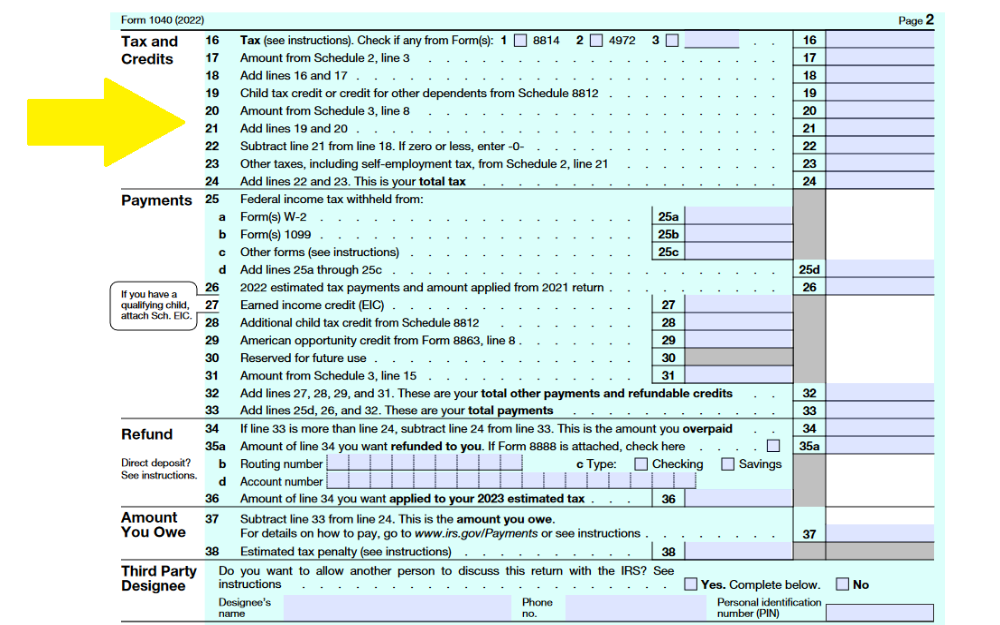

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

New Jersey Clean Energy Program

Energy Efficiency Programs

Renewable Energy Programs

Electric Vehicle Incentive Programs

Solar Ownership and Financing Options

New Construction Program

Community Energy Plans

Metering Requirements

Contact

Power Outage Map

Bureau of Sustainability (BoS)

Phone: (609) 633-0631

Email: [email protected]

Monday – Friday

9 AM – 5 PM

401 East State Street

Trenton, NJ 08608

New Jersey Solar Energy Overview

Solar energy in New Jersey holds the potential for financial gains for the state, with New Jersey solar incentives paving the way for increased home equity and decreased utility bills over time.

Direct profit for homeowners can come through options like the SuSI Program, and others, and residents can register for these programs to qualify for substantial reduction in the cost of solar panels.

NJ is one of the most taxed states.2 Any option to reduce expenses and increase equity is considerable.

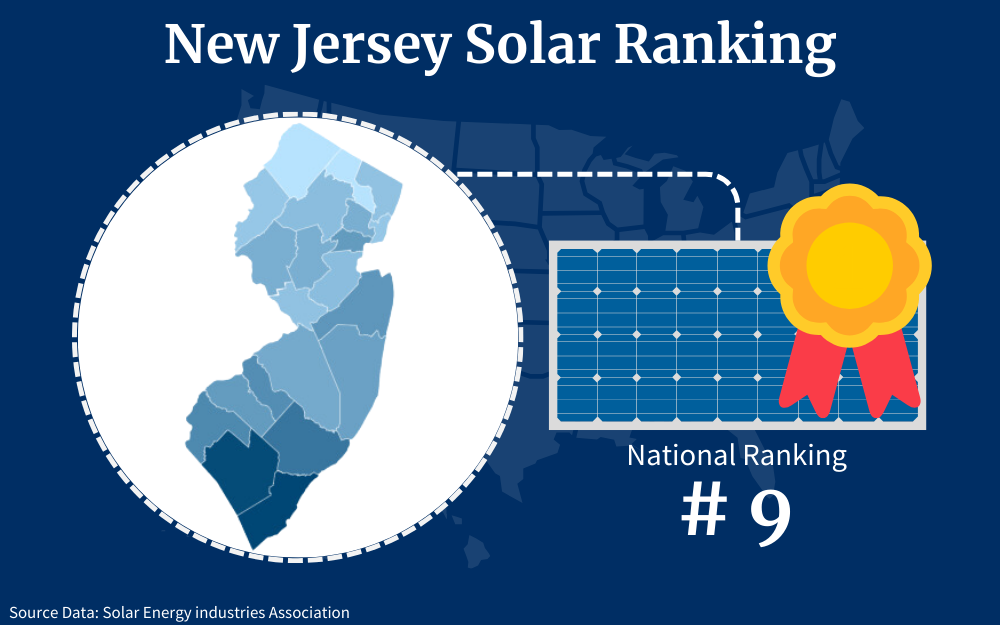

Over 174,692 households in NJ have solar, putting it 9th in the country.3

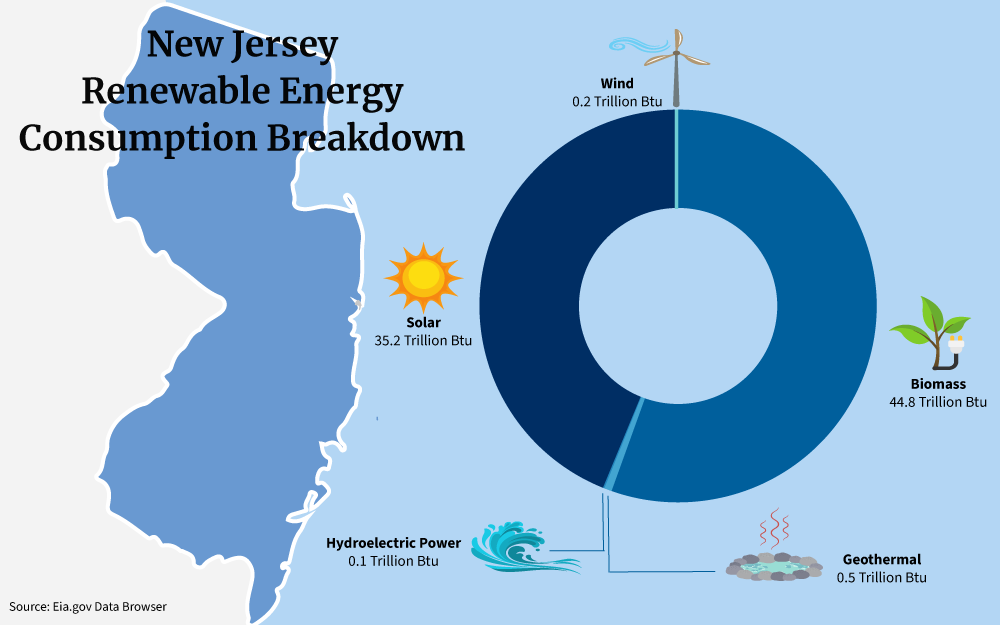

With a 2021 population of 9,261,699 and a 2021 average of 2.66 persons per household, 5.01% of The Garden State’s residents use solar energy.4 In 2021, it was calculated that 7% of total energy production in the state comes from solar.5

Understanding New Jersey solar incentives (and registering for them) isn’t hard, and this comprehensive guide explains all the steps for residents who are interested in home solar energy installations, as well as renewable energy programs and rebates offered by the state.

Solar Credits That Apply in New Jersey

Primary New Jersey solar incentives include the SuSI program, sales tax exemptions, property tax exemptions, net metering, and federal tax credits.

Following we briefly explore each program and associated eligibility requirements.

The SuSI Program

With SuSI, the Successor Solar Incentive (or SREC-II),1 you get $90 for every megawatt-hour (MWh) of electricity your array produces. This is similar to Solar Renewable Energy Certificates (SRECs).

It’s also similar to net metering, with one important difference. For net metering, you sell only excess energy.

With SuSI, you receive $90 for every MWh your system produces. One MWh is equal to 1,000 kilowatts.

On average, NJ residents use 1,281 kW of electricity a month.6 If you installed an array that matched such usage, that’s $1,383.48 a year through SuSI.

Only limited applicants can participate, so sign up fast.7 Register through an ADI or CSI “program portal.”

ADI stands for Administratively Determined Incentive, and CSI is Competitive Solar Incentive. ADI is for solar arrays producing less than 5 megawatts (MW). CSI is for solar arrays producing more than 5 MW.

Submission and registration is necessary prior to construction.

Once you’ve installed the array, you’ll have a post-construction packet to submit. If you get that done properly, you’ll be mailed a certification number.

When you have that number, you can register for what’s known as GATS, the PJM-EIS Generation Attribute Tracking System.8

You can email [email protected] for more precise information on registering prior to construction.

Exemptions on NJ Sales Tax

Stronger solar panels cost more. Thankfully, NJ provides a means of saving automatically.

Sales tax in NJ is 6.625%.9 For a $30,000 solar array, you save $1,987.50 in sales taxes.

Without this exemption, a $30,000 array would really cost you $31,987.50. You don’t have to go through any process to save on sales tax here.

The state simply doesn’t push sales tax on solar equipment and installation, in line with solar panel regulations, offering a 100% exemption.10

You may also consider looking for people who can provide used solar panels for free.

NJ Property Tax Exemption

Another big saver in NJ is property tax exemption. A solar energy array brings, on average, 9.9% in added home equity value for the state of NJ.

That number was established in 2019.11 The average value of a home in NJ is $487,868.

So a 9.9% increase in value from a solar array would bump up the price a homeowner could sell such a property for to $536,166.93. That’s an increase of $48,298.93.12

If you can install a solar array for under $48,000 on an average NJ home, you’ll probably see your net worth expand immediately. The expansion isn’t liquid, but you haven’t actually lost any assets, you just “moved them around.”

You don’t have to fill out any paperwork for this credit. Any property in NJ is appraised for value annually.

When appraisers examine your property, they won’t factor in renewable solar arrays. Like the sales tax exemption, this is also an option that allows the homeowner to enjoy 100% of the associated value from a renewable system.13

New Jersey Net Metering

The NJ-BPU (New Jersey Board of Public Utilities) requires all power companies to provide net metering. Solar arrays often produce more electricity than the needs of residents.

If your array produces more than needed, you can acquire credit back through your utility provider.

These policies apply to individual solar panel installations and community solar projects. Electricity in NJ is 21 cents per kWh; though that varies.14

A solar array designed with 5 kilowatts of productive potential tends to average 20 kWh a day.15 An array like this producing 75% of your need could potentially provide $3.15 a day in net metering benefits.

There are cloudy days, so you shouldn’t expect such an amount to be consistent. However, if there were such a year, then this particular hypothetical solar array represents a value of $1,150.53 in net metering benefits for a 365.25-day year.

Different application protocols exist for different utility companies, there are quite a few to choose from depending on who your provider is.16 Determine the name of your utility company, find it among those listed on the link, and fill out the associated information.

If you are still having trouble, contact your utility provider and get clarification. All utility providers in NJ must provide net metering according to law.

EERE Programs Explained: Residential Solar Tax Credits

There are two primary Energy Efficiency and Renewable Energy (EERE) tax benefits available for NJ residents: the ITC and the PTC credit.17

For either option, it’s advisable to work closely with your accountant or other tax professional.

Doing so helps you get the details right before you file for 2023, or whichever year you install your solar array.

The Investment Tax Credit (ITC)

ITC stands for the Investment Tax Credit. You can apply 30% of the price of your solar array and deduct that from the income for which you’re responsible in the year you install.18

For a solar array that costs $30k, you can claim a $9,000 credit.

The average pay for employees in NJ is $78,550.19 Without other deductions, that puts most NJ residents in the 22% tax bracket unless they’re filing jointly or as the head of a household.

If your annual individual income was $78,550, you could now claim just $69,550 after your $30,000 solar purchase. That means you would only have to pay $15,301 instead of $17,281 for a $1,980 savings within your bracket.

With full deductions, your taxable income is further diminished. It’s possible to knock yourself down a tax bracket and save even more.

If you’re filing as the head of a household, and applied deductions put the sum you’re responsible for at $67,000 in a year, a $30k array would drop that liability down to $58,000; or just under the 22% tax bracket.

Now your annual burden is only 12% of your income. In that instance, the ITC would save you $7,780.

Getting creative with solar arrays and the ITC option will likely save you thousands of dollars in the calendar year you install. To apply for such tax credits, you’ll need to attach an IRS form 5695 to your 1040.20

The Production Tax Credit (PTC)

PTC stands for “Production Tax Credit”, and is like a national net metering incentive for big solar installations. The difference is, that instead of an energy credit from a utility company that reduces electric bills, the federal government provides a tax credit per kilowatt.21

Given the low cost of individual kilowatts, this tends to be less valuable for residential customers. A 5 kW array producing 20 kWh a day on average at a 15 kWh excess would net $1,150.53 in annual deductive potential through the PTC.

A $1,150.53 deduction is not nothing, but it only saves several hundred dollars annually. However, for an apartment complex with 50+ residents using 66,000 or more kW a month, you’re looking at $166,320 a year in deductions.

If you’re pulling in $1,000,000 for rent at a rate of $1,633 per renter, $166,320 in deductions lowers what you have to report by 16.632%. The bigger the installation, the more PTC becomes valuable.

To apply for the PTC tax credit, you’ll need to attach an IRS form 8962 when you file taxes.

What Forms Do I Need To Fill Out To Get the Credit?

For SuSI, email [email protected] to register prior to construction and acquire post-construction info on associated paperwork. Between these two resources, you should be able to find all you need to apply for SuSI.

For ITC eligibility, attach an IRS form 5695 to your 1040.24

Here are 5 simple steps to claim your solar credit using IRS Form 5695 and attaching it to your 1040:

- Gather Required Documentation: Collect all the necessary financial documents related to your solar installation. This includes invoices, payment receipts, and any other records that show the total cost of the system.

- Complete IRS Form 5695: Fill out IRS Form 5695, “Residential Energy Credits”. You will need to input the costs associated with your solar installation and calculate the credit amount based on the current percentage allowed.

- Transfer the Credit Amount: Once you’ve filled out Form 5695 and determined your credit amount, transfer that number to the appropriate line on your main Form 1040.

- Attach Form 5695: When you’re ready to file your Form 1040, ensure that Form 5695 is included with your tax return. If you’re filing electronically, the software should prompt you to include it. If you’re filing on paper, attach the completed Form 5695 to your 1040.

- File Your Taxes: Submit your Form 1040 with the attached Form 5695 to the IRS by the tax deadline. Make sure to keep copies of all documents for your records.

For PTC eligibility, attach an IRS form 8962 when you file.25

For net metering, contact your utility provider and determine their particular requirements. You should be able to find the associated contact info online.26

How Much Does It Cost for Solar Power Systems?

NJ residents average 1,281 kW a month in electricity usage. Most NJ locals will want a solar array to generate at least that amount.

You can use a solar return calculator to get a precise estimate. This may also guide you in calculating the carbon footprint solar panels.

Since most arrays generate four times as much energy as the size of an array in a day, an average system should be 10 or 11 kW.

If you used 1,281 kW a month, you’d need a 10.675 kW solar array at minimum to maintain the same lifestyle. We’ll assume you need an 11 kW array.

As of August 2023, the average cost per watt for solar in NJ is $2.95.27 That cost assumes you avoid Do It Yourself (DIY) approaches.

An 11 kW array is 11,000 Watts, or $32,450. Now there are sources that put the average electricity use in NJ at 600+ kW a month.

Going the DIY route, you’ll need panels, cords, surge controllers, battery arrays, mounts, and power inverters. Ultimately, you’ll pay $1 to $1.50 per Watt.28

At that rate, the cost for an 11 kW array would be $11,000 to $16,500 in NJ. So from either extreme, before any incentives or tax credits, expect $1 to $2.95 per Watt; or $11,000 to $32,450.

That’s assuming you need 1,281 kW of electricity per month. If you only need 640.5 kW of energy a month, you’d be looking at $5,500 to $16,225.

Understanding your monthly electricity bill helps you plan. A good rule of thumb is to put the “top” energy need as your “minimum” for a solar array.

Look at the month with the highest usage, usually, it will be January or February owing to the weather.

How To Use a Residential Solar Panel Calculator

Utilizing a solar panel calculator by address can give you a more accurate estimate of potential savings on utilities and incentives in New Jersey. Factoring in equity, you’re likely going to see immediate value for solar installation across the state, meaning you don’t actually lose assets.

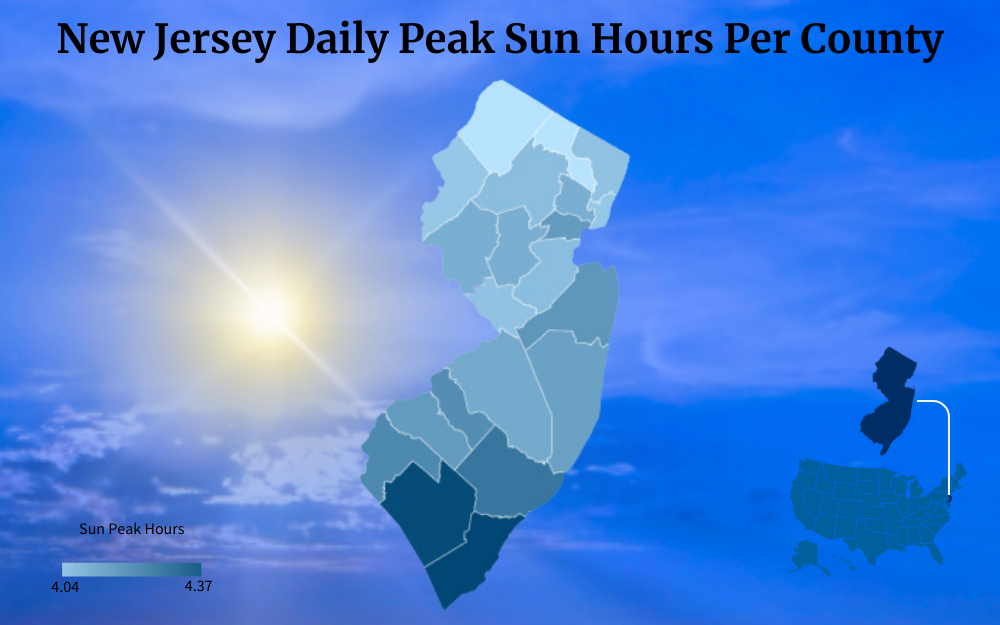

Averaging 4 hours of sunlight each day, New Jersey provides the solar energy you’ll need for a home solar system.

When learning how to calculate the number of solar panels you’ll need, you need to fist understand how much energy you use.

The National Renewable Energy Laboratory (NREL) offers a calculator that allows you to figure the type of panels that will provide the energy you need.

Once you know the size of your home solar energy system, you can factor in the savings New Jersey solar incentives offer.

A properly installed solar array will increase net worth but, considering the average lifespan of solar panels, the financial benefits for an average NJ resident will likely surpass the initial installation expenses.

Here are the considerable variables:

- ITC Savings

- The SuSI Program

- Net Metering Potential

- Utility Expense Deferral

- Sales Tax Exemptions

- Equity Exemptions

ITC Savings

With the ITC, 30% of installation costs can be deducted from annual taxes. For a $32,450 solar array, you can claim $9,735.

Average NJ residents make $78,550 annually, or a 22% tax burden of $17,281. With ITC, you subtract $9,735, dropping taxable income to $68,815.

Now you only owe $15,139.30. In this instance, you’ve saved $2,141.70.

This assumes your only deduction is the ITC option, and excludes sales tax reduction on installation costs. In all likelihood, there will be more deductions.

This credit could drop you from the 22% tax bracket to the 12% tax bracket, which will save you thousands more. For now, assume an average tax savings of $2,141.70 in the year you install.

The SuSI Program

With the SuSI Program, you get $90 per MW produced. At an average of 1,281 kW per month, you’re looking at 15.372 MW a year, which comes to $1,383.48.

If that’s your monthly energy usage, you’ll get a little more than a dollar per kilowatt for an average of $115.29 a month.

Basically, add up all kW per year and divide by 1,000, then multiply the sum by 90 for the dollar amount you can earn through SuSI. The average for NJ is $1,383.48.

Net Metering Potential

NJ Net Metering pays 21 cents per kilowatt produced over need. An 11 kW system should produce 44 kWh a day, or 1,320 a month.

If you need 1,281 a month, you’re looking at 39 extra kWh a month. That’s about $98.28 a year in net metering credits.

Some months will provide you with more than others.

Utility Expense Deferral

At 21 cents per kilowatt, and 1,281 kW per month, you’re looking at $3,228.12 a year. A robust enough solar array will severely, if not totally, reduce that cost.

Sales Tax Exemptions

Sales tax in NJ is 6.625%. Solar energy increases property value by 9.9% on average.

At $2.95 per Watt, you’re looking at $32,450. You can subtract $2,149.81 from that sum owing to sales tax reduction.

Now you’re looking at $30,300.19.

Equity Exemptions

Average home values are $487,868 in NJ. If you add an 11 kW array, you should increase that value by 9.9%, expanding the value by $48,298.93.

Now your home can command an asking price of $536,166.93. That’s an increase in your net worth without incentives or utility deferrals.

$30,300.19 just brought you $17,998.74 in value in your first year solely through equity increase.

Calculating Everything Together

We’ve avoided commercial savings calculations because they will vary so much. Average savings for average NJ residents are calculated for a minimum investment of $32,450.

You can subtract $2,149.81 in sales tax, $3,228.12 in deferred utilities, $98.28 in net metering credits, $1,383.48 from SuSI payout, and $2,141.70 through the ITC.

A $32,450 solar array now only costs $23,448.61. Essentially, cut 27.7% from baseline cost after incentives.

If said expenses were $15,000, that drops to around $10,845.

You’ll still be out $23,448.61 in liquid assets on average. In 7.26 years, your solar array pays for itself directly in deferred utility costs.

If you combine deferred utility with net metering and SuSI, you’re looking at $4,709.88 in deferred costs annually. That means in under 5 years, your solar array has paid for itself–provided you pursue all benefits.

As an added bonus, home equity remains.

For a $32,450 array, subtract 27.7% in benefits/incentives/taxes. Get full net metering and SuSI eligibility, and after 5 years, you have made $48,298.93 in direct equity (if your home is at average value).

Follow this model, and you will increase your net worth by $9,659.78 every single year. That’s ROI if you maximize benefit potential.

Should you sell a property after an array has paid for itself, that’s almost $50,000 in assets that wouldn’t exist otherwise. This is an “ideal” scenario, but it’s worth considering.

Can I Sell Power Back to the Grid?

You can sell power back to the grid in NJ, average solar home power may produce $98.28 a year. This is possible through net metering as explored earlier.

Net metering is also known as a PPA, or Power Purchase Agreement.29 All utility companies in NJ are required to provide PPA options via net metering.

Using Photovoltaic Cells in New Jersey for the Solar Grid

The question “What is PV?” comes up frequently. PV stands for Photovoltaic.

PV solar panels are the most common. The truth about solar panels is that not all solar panels are the same.

Going the “cheap” route invites replacement and intensive maintenance. Maintenance costs reduce savings and expense deferral.

The EPA estimates PV arrays properly installed last 30 to 35 years.30 It’s more realistic to assume they’ll last 10 to 20.

A hail storm can knock out a panel. Thankfully, replacing one panel is a matter of removing the broken one and plugging the new one in.

The best solar arrays have mounts that track the sun, quality panels, quality cords, effective surge controllers, and properly sequenced battery arrays. A 10 kWh solar battery lasts about 24 hours without sun,22 NJ gets 93 days of sun a year,23 so you probably want 4 batteries in the event of a storm; they can store up energy for sunless use.

Choosing Solar Installation Company

When searching for solar installers, New Jersey (like all states) will provide a host of potential companies.

Read online reviews, ask around, and try to find solar users who have had an array installed for several years. Don’t just choose the first company you encounter, look at multiple options.

The right company can probably help you with incentive applications as well.

NJ is one of the most ideal states for solar energy. Between incentives and property value enhancement, you can recoup investment collaterally and directly.

Even without taking into account these incentives, the savings from reduced utility costs accumulate over time, embodying the concept that solar is freedom.

Average monthly electricity bills are $3,228.12 a year. That’s $32,281.20 in ten years.

Considering the sales tax reduction and New Jersey solar incentives and federal solar incentives, your solar panels can become cost-effective within a decade, making solar installations in NJ a great way to save money and reduce your household emissions.

Frequently Asked Questions New Jersey Solar Incentives

Will Solar Energy Help Reduce My Tax Burden in New Jersey?

The ITC tax credit, sales tax reduction, and property value enhancement represent three ways solar energy can save you thousands of dollars in taxes every year across NJ.

Should I Have Solar Installed, or Go the DIY Route in New Jersey?

You would do better to have solar providers help install an array. There are many DIY kits, and this route saves 50% to 66% or more over installation, but you get what you pay for and if you don’t do the job right, you’ll see such costs return owing to maintenance.

How Long Do I Have To Wait for ROI on Solar in New Jersey?

Because of NJ’s robust solar profile, property value averages, and associated taxation, your net worth increases upon proper installation of a representative array. If you design your array with equity in mind, you can see illiquid net worth ROI immediately on installation.

References

1Successor Solar Incentive (SuSI) Program – New Capacity Installed by 2026. (2021, August 27). NJ.gov. Retrieved September 14, 2023, from <https://nj.gov/bpu/pdf/New%20Jersey%20Solar%20Factsheet_FINAL.pdf>

2Cangialosi, C. (2023, March 28). New Jersey Has 6th Highest Tax Burden Among 50 States in 2023: Study. TAPinto. Retrieved September 14, 2023, from <https://www.tapinto.net/towns/raritan-bay/sections/business-and-finance/articles/new-jersey-has-6th-highest-tax-burden-among-50-states-in-2023-study>

3NJDEP-Air Quality, Energy & Sustainability. (2023, June 19). NJ.gov. Retrieved September 14, 2023, from <https://www.nj.gov/dep/aqes/opea-solar.html>

4New Jersey. (n.d.). U.S. Census Bureau QuickFacts: New Jersey. Retrieved September 14, 2023, from <https://www.census.gov/quickfacts/fact/table/NJ/PST045222>

5New Jersey Profile. (2022, November 17). EIA. Retrieved September 14, 2023, from <https://www.eia.gov/state/print.php?sid=NJ>

6Electricity Cost in New Jersey: 2023 Electric Rates. (n.d.). EnergySage. Retrieved September 14, 2023, from <https://www.energysage.com/local-data/electricity-cost/nj/>

7Successor Solar Incentive (SuSI) Program | NJ OCE Web Site. (2021, July 28). New Jersey Clean Energy Program. Retrieved September 14, 2023, from <https://njcleanenergy.com/renewable-energy/programs/susi-program>

8Registering a Solar Generator Residential/Small Business. (2019, May 28). Solar Incentives NJ. Retrieved September 14, 2023, from <https://solarincentivesnj.com/wp-content/uploads/2021/11/GATS-Solution-Aid-Registering-a-Generator-D699212_.pdf>

9NJ Department of State – Regulations, Taxes In NJ. (n.d.). NJ.gov. Retrieved September 14, 2023, from <https://www.nj.gov/state/njfilm/regulations-taxes.shtml>

10DSIRE. (n.d.). DSIRE. <https://programs.dsireusa.org/system/program/detail/219/solar-energy-sales-tax-exemption>

11The 10 states where solar power can boost a home’s value the most. (2019, October 5). CNBC. Retrieved September 14, 2023, from <https://www.cnbc.com/2019/10/05/solar-power-can-boost-a-homes-value-in-these-10-states-the-most.html>

12New Jersey Home Prices & Home Values. (n.d.). Zillow. Retrieved September 14, 2023, from <https://www.zillow.com/home-values/40/nj/>

13Property Tax Exemption for Renewable Energy Systems. (n.d.). DSIRE. <https://programs.dsireusa.org/system/program/detail/3100/property-tax-exemption-for-renewable-energy-systems>

14Electricity Cost in New Jersey: 2023 Electric Rates. (n.d.). EnergySage. Retrieved September 14, 2023, from <https://www.energysage.com/local-data/electricity-cost/nj/>

15HOW MUCH POWER SHOULD MY SOLAR SYSTEM BE PRODUCING? (2019, April 1). Solar Power Australia. Retrieved September 14, 2023, from <https://www.solarpoweraustralia.com.au/solar-system-production>

16Interconnection Utility Contacts | NJ OCE Web Site. (n.d.). New Jersey’s Clean Energy Program. Retrieved September 14, 2023, from <https://www.njcleanenergy.com/renewable-energy/programs/net-metering-and-interconnection/interconnection-forms>

17Federal Solar Tax Credits for Businesses. (n.d.). Department of Energy. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses#_edn2>

18Federal Solar Tax Credits for Businesses. (n.d.). Department of Energy. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

19New Jersey average annual pay U.S. 2022. (2023, June 19). Statista. Retrieved September 14, 2023, from <https://www.statista.com/statistics/305775/new-jersey-annual-pay/>

20Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

21Renewable Electricity Production Tax Credit Information | US EPA. (2023, February 22). EPA. Retrieved September 14, 2023, from <https://www.epa.gov/lmop/renewable-electricity-production-tax-credit-information>

22Bolt, O. (2023, June 22). How Long Does a Solar Battery Last at Night? Energy Theory. Retrieved September 14, 2023, from <https://energytheory.com/how-long-does-a-solar-battery-last-at-night/>

23Monthly Amount of Sunshine for New Jersey. (n.d.). Current Results. Retrieved September 14, 2023, from <https://www.currentresults.com/Weather/New-Jersey/sunshine-by-month.php>

24Internal Revenue Service. (2023). Form 1040. IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

25Premium Tax Credit (PTC). (n.d.). IRS. Retrieved September 14, 2023, from <https://www.irs.gov/pub/irs-pdf/f8962.pdf>

26Interconnection Utility Contacts | NJ OCE Web Site. (n.d.). New Jersey’s Clean Energy Program. Retrieved September 14, 2023, from <http://www.njcleanenergy.com/renewable-energy/programs/net-metering-and-interconnection/interconnection-forms>

27How Much Do Solar Panels Cost in New Jersey? (2023). (n.d.). MarketWatch. Retrieved September 14, 2023, from <https://www.marketwatch.com/guides/home-improvement/solar-panel-cost-new-jersey/>

28Hyder, Z. (2023, January 12). DIY Solar Panels: Pros, Cons & 6-Step Cost Savings Guide. SolarReviews. Retrieved September 14, 2023, from <https://www.solarreviews.com/blog/pros-and-cons-of-buying-diy-solar-panels>

29Solar Power Purchase Agreements | US EPA. (2023, February 5). EPA. Retrieved September 14, 2023, from <https://www.epa.gov/green-power-markets/solar-power-purchase-agreements>

30End-of-Life Management for Solar Photovoltaics. (n.d.). Department of Energy. Retrieved September 14, 2023, from <https://www.energy.gov/eere/solar/end-life-management-solar-photovoltaics>

31Photo by Todd Baylson. – U.S. Department of Energy from United States – Baylson_000290_171088_515945_4578, Public Domain, <https://commons.wikimedia.org/w/index.php?curid=74497182>